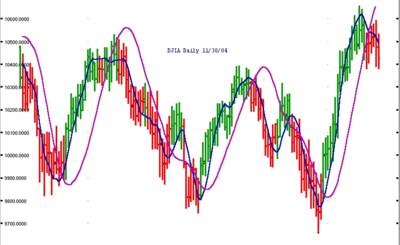

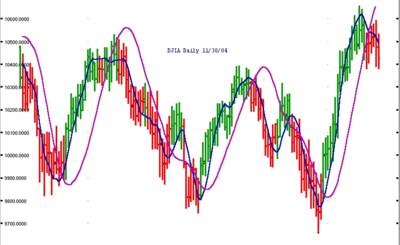

DJIA Daily Tuesday, 30-Nov-2004

The market decline continues today, going down 46 points. It's still too early to tell how far down the DJIA will go, but today's movement was somewhat restrained, I think. Acceleration to the downside should occur tomorrow.

The market decline continues today, going down 46 points. It's still too early to tell how far down the DJIA will go, but today's movement was somewhat restrained, I think. Acceleration to the downside should occur tomorrow.

It's still too early to predict how low the Dow will go with the methods currently at my disposal. If other concepts or indicators are found to be better predictors, I'll post them on this site.

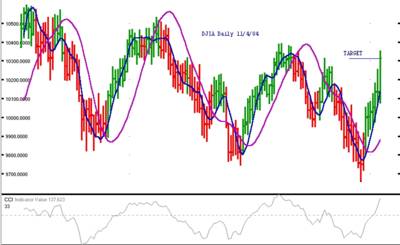

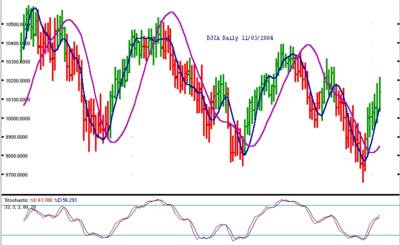

DJIA Daily Mon 29-Nov-2004

The Dow (DJIA) went down 46 points today, finally capitulating to selling pressure (or lack of buying pressure). The downtrend begins, now how low will it go? Let's see where the next pause is and then we can project a downside target.

The Dow (DJIA) went down 46 points today, finally capitulating to selling pressure (or lack of buying pressure). The downtrend begins, now how low will it go? Let's see where the next pause is and then we can project a downside target.

Not much to write. The market went up 2 pts. in a slow, shortened trading day. The red bars continue, even as the market creeps back up. I expect lower prices to resume on Monday.

Not much to write. The market went up 2 pts. in a slow, shortened trading day. The red bars continue, even as the market creeps back up. I expect lower prices to resume on Monday.

The market moved up slightly, which I anticipated might happen. The Dow is still very overbought and even though the stochastic lines have crossed again, the market still should go down for a bit. Next week still should be lower than this week.

The market moved up slightly, which I anticipated might happen. The Dow is still very overbought and even though the stochastic lines have crossed again, the market still should go down for a bit. Next week still should be lower than this week.

DJIA Daily Tue 23-Nov-2004

Not much movement today in the Dow, although it closed up slightly. The two proprietary moving averages touched today and will cross tomorrow. It's still too early to determine how low the correction will go. The market could go up slightly tomorrow until next week when it's true direction will be determined. If I had to predict, the market will be lower next week than this one.

Not much movement today in the Dow, although it closed up slightly. The two proprietary moving averages touched today and will cross tomorrow. It's still too early to determine how low the correction will go. The market could go up slightly tomorrow until next week when it's true direction will be determined. If I had to predict, the market will be lower next week than this one.

DJIA Daily Mon 22-Nov-2004

Today's price bar on the DJIA was red, indicating a downtrend, at least temporarily. However, the market closed up 32 points on the day. Is this a quick reversal day? (A reversal day is a price bar, in a downtrend that's lower than the previous low, yet closes up on the session). I think we have more to go on the downside, but how much I can't predict until we see the almost inevitable mid-point inside day or small range day.

Today's price bar on the DJIA was red, indicating a downtrend, at least temporarily. However, the market closed up 32 points on the day. Is this a quick reversal day? (A reversal day is a price bar, in a downtrend that's lower than the previous low, yet closes up on the session). I think we have more to go on the downside, but how much I can't predict until we see the almost inevitable mid-point inside day or small range day.

I was expecting a big move, but to the upside, not downward. If you check the posts over the last few days, I thought the market was topping, but it continued higher for some sessions. If I were trading, the losses suffered in the market moving higher wouldn't have been tolerable and I would've been stopped out before this downturn. And it is a downturn--how far, we'll have to see what the price bars tell us about the psychology of the market at this time.

I was expecting a big move, but to the upside, not downward. If you check the posts over the last few days, I thought the market was topping, but it continued higher for some sessions. If I were trading, the losses suffered in the market moving higher wouldn't have been tolerable and I would've been stopped out before this downturn. And it is a downturn--how far, we'll have to see what the price bars tell us about the psychology of the market at this time.

The price bars are still green, but if you look at the last few tops, if you stayed in the market until the bars changed color, you'd give up too much of your profit.

What has this exercise taught me thus far? The target setting I originally had still seems valid. You can't chase the market and get the last few "drops" of dollars from it, you just need to wait until everything is a "go". But can I do better in predicting the market? We'll see on this next move.

Today was an indside day in the Dow Industiral average. That means it's another day of indecision--will the bulls or bears prevail in the resolution? As the moving averages still haven't crossed, we'll still guess that the market will make the 10814 target and quickly. This move in the market is very overextended and if it will make a final push up, it will come very quickly, maybe by the close on Monday.

Today was an indside day in the Dow Industiral average. That means it's another day of indecision--will the bulls or bears prevail in the resolution? As the moving averages still haven't crossed, we'll still guess that the market will make the 10814 target and quickly. This move in the market is very overextended and if it will make a final push up, it will come very quickly, maybe by the close on Monday.

DJIA Daily Wed 16-Nov-2004

The market moved up sharply, on bad news no less, and though came down some, ended 62 points higher. The bad news was a higher than expected CPI number suggesting higher inflation in the future. The market may be turning over, but it's going higher first.

The market moved up sharply, on bad news no less, and though came down some, ended 62 points higher. The bad news was a higher than expected CPI number suggesting higher inflation in the future. The market may be turning over, but it's going higher first.

Will the new target of 10814 hold? As long as the bars are green and the blue line is over the purple one, we'll stay long.

DJIA Daily Tue 16-Nov-2004

The market finally had a down day, going 62 points lower. Again, my initial feeling that we were near the top seems to be vindicated, although only a few more down days would confirm it. If I were still long, taking profits would seem to be a good idea, before giving back a lot of the gain. I'd be very surprised if tomorrow were an up day--I think this is the beginning of a downtrend, or correction, at least. Tomorrow will tell.

The market finally had a down day, going 62 points lower. Again, my initial feeling that we were near the top seems to be vindicated, although only a few more down days would confirm it. If I were still long, taking profits would seem to be a good idea, before giving back a lot of the gain. I'd be very surprised if tomorrow were an up day--I think this is the beginning of a downtrend, or correction, at least. Tomorrow will tell.

DJIA Daily Mon 15-Nov-2004

The market crept up a little more today, another 11+ points. On a long swing like this, maybe the exit point should be the crossing of the proprietary moving averages (13 & 33 bars in length). If you notice, these proprietary averages from the Investograph program don't lag the market much at all, that's why I find them more useful than other moving averages. 10814 as the target now?

The market crept up a little more today, another 11+ points. On a long swing like this, maybe the exit point should be the crossing of the proprietary moving averages (13 & 33 bars in length). If you notice, these proprietary averages from the Investograph program don't lag the market much at all, that's why I find them more useful than other moving averages. 10814 as the target now?

Friday DJIA daily 12-Nov-2004

The market moved up more today, closing up 70 points. If we were just judging the market by the green bars (7 period Least Square Momentum indicator > 0) we would have entered the day after the first green bar and still be in the Dow long. The first green bar was on Wed. Oct. 27 and the open the next day was 9998.94. From there up to today's close, 10539 is 540 points, quite a nice call, and maybe more to come. I said the market looked positive and would have entered on Tuesday at an open of 9750, but then, based on a target explained earlier, would have exited on Thu. Nov. 11 at 10312. We would have left, so far, 225 points while watching from the sidelines. Sometimes, when there is uncertainty, you shouldn't kick yourself for missing all or part of a move, as long as when you trade you're successful. You'll drive yourself crazy otherwise.

The market moved up more today, closing up 70 points. If we were just judging the market by the green bars (7 period Least Square Momentum indicator > 0) we would have entered the day after the first green bar and still be in the Dow long. The first green bar was on Wed. Oct. 27 and the open the next day was 9998.94. From there up to today's close, 10539 is 540 points, quite a nice call, and maybe more to come. I said the market looked positive and would have entered on Tuesday at an open of 9750, but then, based on a target explained earlier, would have exited on Thu. Nov. 11 at 10312. We would have left, so far, 225 points while watching from the sidelines. Sometimes, when there is uncertainty, you shouldn't kick yourself for missing all or part of a move, as long as when you trade you're successful. You'll drive yourself crazy otherwise.

However, this is an educational website, to educate myself and other interested traders and to determine whether the market is predictable or not.

If the consolidation of the last few days is a mid-point of the swing, the question is mid-point from what? Let's take it as a mid-point from our target of 10312, so we would project a new target of ((10400-9986)+10400) or

10814. This move still has been extended a long way and the indicators are very overbought, so if I were to enter a trade, I'd try to be conservative, maybe entering above the high of today's bar, (10565) and putting a stop to exit at today's close or 10539. I still think it likely for the market to come down and wouldn't want to be caught in a big down day. I will explore a shorter time frame of LS Momentum indicators to exit trades and let you know if that seems useful.

DJIA daily chart 11-Nov-2004

The bars are still green signifying an uptrend. However, I predicted based on the indicators below the price bar chart and because we are beyond the target we predicted earlier, that the market was topping and would go down, at least for a while, if not longer. It hasn't happened yet. I still think this is a topping pattern and expect a down move any day now. What we convince me the prediction is wrong? Certainly a close above 10600. We'll see how the Dow moves tomorrow and have a weekend update on the market.

The bars are still green signifying an uptrend. However, I predicted based on the indicators below the price bar chart and because we are beyond the target we predicted earlier, that the market was topping and would go down, at least for a while, if not longer. It hasn't happened yet. I still think this is a topping pattern and expect a down move any day now. What we convince me the prediction is wrong? Certainly a close above 10600. We'll see how the Dow moves tomorrow and have a weekend update on the market.

DJIA daily chart 10-Nov-2004

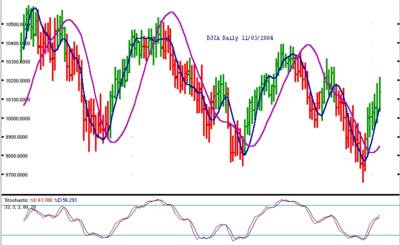

Another sideways move in the market today. The market participants aren't sure whether to buy or sell and so the DJIA is stalled for another day. The stochastics, as expected crossed today--a further indication (not guarantee) that the market will resolve this indecision to the downside. The question really still is, will it just be a small dip downward or a major down swing. The prices will give us a technical clue as we get more data.

Another sideways move in the market today. The market participants aren't sure whether to buy or sell and so the DJIA is stalled for another day. The stochastics, as expected crossed today--a further indication (not guarantee) that the market will resolve this indecision to the downside. The question really still is, will it just be a small dip downward or a major down swing. The prices will give us a technical clue as we get more data.

DJIA daily chart 09-Nov-2004

The topping pattern continues today. Consolidations like this, short bars, either show the halfway point of a swing move or a top. This still looks like a top to me. The stochastics are almost crossing today and should cross tomorrow. We may have more sideways bars, but then the likelyhood is for a down move. How far down? Will it just be a correction in a bigger up move? We'll wait to see what the market tells us by the levels people are willing to buy or sell the market. I don't know of a system which will want you to trade a market like this other than an option straddle, waiting for a breakout one way or the other.

The topping pattern continues today. Consolidations like this, short bars, either show the halfway point of a swing move or a top. This still looks like a top to me. The stochastics are almost crossing today and should cross tomorrow. We may have more sideways bars, but then the likelyhood is for a down move. How far down? Will it just be a correction in a bigger up move? We'll wait to see what the market tells us by the levels people are willing to buy or sell the market. I don't know of a system which will want you to trade a market like this other than an option straddle, waiting for a breakout one way or the other.

DJIA daily chart 08-Nov-04

The market paused today, with an "inside day" bar (the high was lower than yesterday's high and the low was higher than yesterday's low). This looks like a topping pattern for this move and the CCI and Stochastics seem to confirm this. If I were trading, I would wait to make a move and the next move looks to be down.

The market paused today, with an "inside day" bar (the high was lower than yesterday's high and the low was higher than yesterday's low). This looks like a topping pattern for this move and the CCI and Stochastics seem to confirm this. If I were trading, I would wait to make a move and the next move looks to be down.

DJIA daily chart 05-Nov-2004

The DJIA went up 72 points today, not exactly a pause as I predicted yesterday. The trend of waves of lower highs and lower lows has been broken with today's move up. A pause or at least temporary reversal (if not outright reversal) is very likely for Monday, I think. The CCI gray line below the price bars is at it's highest level in more than six months and the parabolic trend up won't continue forever.

The DJIA went up 72 points today, not exactly a pause as I predicted yesterday. The trend of waves of lower highs and lower lows has been broken with today's move up. A pause or at least temporary reversal (if not outright reversal) is very likely for Monday, I think. The CCI gray line below the price bars is at it's highest level in more than six months and the parabolic trend up won't continue forever.

The high today on the Dow was 10458, more than 140 points above our target. Should I try to modify my methods so those points won't be left on the table? At this point, considering I think a pause or reversal is imminent, it's not worth the risk. If the market continues up with a pause (highly unlikely) then I may have to rethink my position.

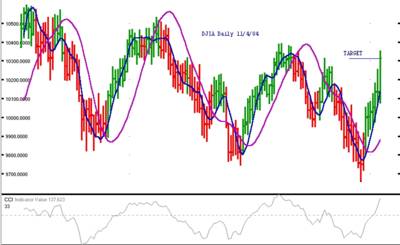

TARGET reached for DJIA 11-Nov-2004

TARGET for DJIA reached today!!

TARGET for DJIA reached today!!

As predicted on Thursday, October 28, we predicted a DJIA target on this swing of 10312. Today that target was reached and the market closed at 10314.

I posted on Monday, October 25 that the market should go up until election day. On Thursday, 10/28 the target price was predicted and I said that the market would take a little longer to make the target. A little longer was just two days. These methods caught the full swing of the move, from the open on Tuesday, October 26 of 9750, or to be more conservative, entry above the high of the previous day (9827) up to 10312 or between 485-562 points.

Now, the next question. Where does the market go from here? Since the target level was reached today, the market will either pause tomorrow, possibly going a little higher or reverse course and go lower. I expect that this move up is exhausted, or just about done. This is the time to stand aside, according to the methods outlined here and see what the market does, but I'd look for lower levels on the Dow next week.

DJIA daily chart 03-Nov-2004

The target guess of 10312 holds today. A good move of 100+ pts. in the Dow average, allegedly because of President Bush's re-election. We're not looking at news, just predictions of the market, not WHY it went to certain levels. You'd have to be right twice and the way to make money in the market is not "why" the market moved, but "when" and "where" it will move.

The target guess of 10312 holds today. A good move of 100+ pts. in the Dow average, allegedly because of President Bush's re-election. We're not looking at news, just predictions of the market, not WHY it went to certain levels. You'd have to be right twice and the way to make money in the market is not "why" the market moved, but "when" and "where" it will move.

DJIA daily chart 02-Nov-2004

The market continues up, although uncertainty about the election is keeping a lid on the market. The target remains the same, but it may take a few more days to get to it.

The market continues up, although uncertainty about the election is keeping a lid on the market. The target remains the same, but it may take a few more days to get to it.

DJIA daily chart 01-Nov-2004

Tomorrow may be another small range day, like today, or could move quite a bit higher.

Tomorrow may be another small range day, like today, or could move quite a bit higher.