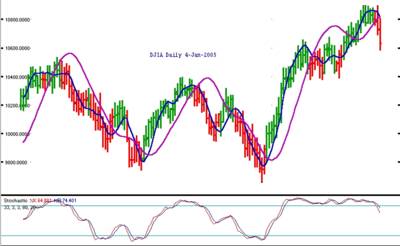

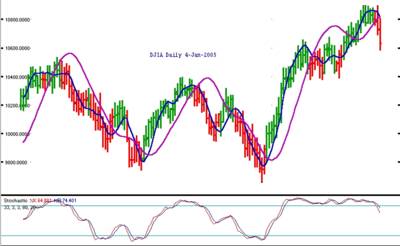

Tomorrow will tell the story, but after going up 62 points today, the Dow very well may move higher from this base. The only thing that would save the prediction of a down swing, would be not to break the high of three days ago, around 10571, or so. Let's watch the price action. The market was quite indecisive during the day after opening higher, but even though the weekly indicators are down, the daily ones look up.

Tomorrow will tell the story, but after going up 62 points today, the Dow very well may move higher from this base. The only thing that would save the prediction of a down swing, would be not to break the high of three days ago, around 10571, or so. Let's watch the price action. The market was quite indecisive during the day after opening higher, but even though the weekly indicators are down, the daily ones look up.

The DJIA was up 34 points on the week in what is considered a reversal price bar. It made a lower low than last week, yet closed up. The indicators below still look like the market is going south, so the ambiguous indicators in the daily price chart (below) might be resolved by lower prices on the Dow. Any upward move looks like it would be short-lived. Let's see how bext week starts.

The DJIA was up 34 points on the week in what is considered a reversal price bar. It made a lower low than last week, yet closed up. The indicators below still look like the market is going south, so the ambiguous indicators in the daily price chart (below) might be resolved by lower prices on the Dow. Any upward move looks like it would be short-lived. Let's see how bext week starts.

Although the Dow dropped 40 points, the price bar turned green today. However, my statement yesterday still holds, if the market breaks the low of (now) four days ago, the market will continue lower, otherwise, it will shoot up. The weekly chart, above, still shows a red price bar, even though the market was up on the week. I thought the market would hit our target of 10210 this week. It didn't and based on price action, might not. A lower market on Monday would validate our prediction, otherwise, look up.

Although the Dow dropped 40 points, the price bar turned green today. However, my statement yesterday still holds, if the market breaks the low of (now) four days ago, the market will continue lower, otherwise, it will shoot up. The weekly chart, above, still shows a red price bar, even though the market was up on the week. I thought the market would hit our target of 10210 this week. It didn't and based on price action, might not. A lower market on Monday would validate our prediction, otherwise, look up.

Down today, as expected, but not severly, only 31 points. The stochastics indicator still ticked up, but the CCI which is more sensitive turned down today. Should the market go below the low price of three days ago, 10317, we should feel good about it hitting our target of 10210. If it doesn't go below it, get ready for a rocket upward.

Down today, as expected, but not severly, only 31 points. The stochastics indicator still ticked up, but the CCI which is more sensitive turned down today. Should the market go below the low price of three days ago, 10317, we should feel good about it hitting our target of 10210. If it doesn't go below it, get ready for a rocket upward.

Up another 37 points today, tomorrow is the key day for the Dow. Will it continue upwards, solidifying a new trend, or will this "correction" in the downtrend end and the market plummet toward our target of 10210? Tomorrow tells the story.

Up another 37 points today, tomorrow is the key day for the Dow. Will it continue upwards, solidifying a new trend, or will this "correction" in the downtrend end and the market plummet toward our target of 10210? Tomorrow tells the story.

The Dow shot up 95 points--well it was oversold as you can see by the indicators below the price bars. I still think the prices point lower; they can't go down every day, after all. Let's see if the downtrend resumes tomorrow as I expect.

The Dow shot up 95 points--well it was oversold as you can see by the indicators below the price bars. I still think the prices point lower; they can't go down every day, after all. Let's see if the downtrend resumes tomorrow as I expect.

Down another 24 points today, the Dow has a little more than 150 points to go down before it reaches our target around 10209-10. The stochastics indicator just went below the lower oversold level, but I still think the target is reachable this week.

Down another 24 points today, the Dow has a little more than 150 points to go down before it reaches our target around 10209-10. The stochastics indicator just went below the lower oversold level, but I still think the target is reachable this week.

The DJIA went down 165 points this week. Another 180 or so, and we'll reach our daily target or 10210. Note that the price bar is now red, as expected, predicting further lower prices. The stochastics indicator is definitively downward in slope and the short term moving average is pointing south as well. No way to predict a weekly price target yet, but as I expect lower prices next week and then probably a pause, I should be able to predict prices either next week or the week after from this chart.

The DJIA went down 165 points this week. Another 180 or so, and we'll reach our daily target or 10210. Note that the price bar is now red, as expected, predicting further lower prices. The stochastics indicator is definitively downward in slope and the short term moving average is pointing south as well. No way to predict a weekly price target yet, but as I expect lower prices next week and then probably a pause, I should be able to predict prices either next week or the week after from this chart.

Another 78 point drop in the Dow today. The market is falling toward our 10210 target and should reach it, oh, by mid-week, I'd say. Then the market should consolidate then decide whether to go back up or drop more.

Another 78 point drop in the Dow today. The market is falling toward our 10210 target and should reach it, oh, by mid-week, I'd say. Then the market should consolidate then decide whether to go back up or drop more.

The market went down 68 points today and I redrew the target line at the 10210 level. We might reach it next week, and I expect it to get there then. The concern yesterday about the short term moving average turning up, was unfounded. The line turned down today. Let's watch this drop together, then we'll see if it will go down beyond the target, or if it will turn up from there.

The market went down 68 points today and I redrew the target line at the 10210 level. We might reach it next week, and I expect it to get there then. The concern yesterday about the short term moving average turning up, was unfounded. The line turned down today. Let's watch this drop together, then we'll see if it will go down beyond the target, or if it will turn up from there.

Although the market switched course again and went down 88 points today, a little troubling indicator is that the short term proprietary moving average turned up slightly. Even with that, I expect the market downtrend to resume and the target mentioned a few days ago to be reached.

Although the market switched course again and went down 88 points today, a little troubling indicator is that the short term proprietary moving average turned up slightly. Even with that, I expect the market downtrend to resume and the target mentioned a few days ago to be reached.

Although the market was up 71 points today and created another "outside day", the market is treading water(going sideways) until dropping toward our target. The sideways move may continue for the rest of the week or we may see capitulation and the downtrend continue before Saturday.

Although the market was up 71 points today and created another "outside day", the market is treading water(going sideways) until dropping toward our target. The sideways move may continue for the rest of the week or we may see capitulation and the downtrend continue before Saturday.

The Dow closed down 45 points this week and the short-term average turned down, as well. The indicators have rolled over from very overbought conditions, but the price bar is still green. Another down close next week should change it to red, however. It looks like lower prices upcoming, but no weekly predictions can be made at this time with the indicators I use.

The Dow closed down 45 points this week and the short-term average turned down, as well. The indicators have rolled over from very overbought conditions, but the price bar is still green. Another down close next week should change it to red, however. It looks like lower prices upcoming, but no weekly predictions can be made at this time with the indicators I use.

Although the Dow was up today, it was an inside day. Because of this indecision day, as I call it, we've got a new target-- 10550-(10892-10550)= 10208 I've put a line at the 10210 level, it would have to be a big down week to reach it, almost 350 points. Let's see if early in the week we have some "bad" market news to get us close to, or down to this level.

Although the Dow was up today, it was an inside day. Because of this indecision day, as I call it, we've got a new target-- 10550-(10892-10550)= 10208 I've put a line at the 10210 level, it would have to be a big down week to reach it, almost 350 points. Let's see if early in the week we have some "bad" market news to get us close to, or down to this level.

As expected, the Dow closed down today, 111 points down. The market reporters said it was because GM came in with lower than expected results for last quarter. I didn't know, or expect GM to report as it did and even so, GM's report may not be why the market closed lower. Technical analysis of the type I do predicted lower prices--I didn't need to know any "fundamental" market reasons for it. Looking toward the 10375 target which we'll probably make on Monday.

As expected, the Dow closed down today, 111 points down. The market reporters said it was because GM came in with lower than expected results for last quarter. I didn't know, or expect GM to report as it did and even so, GM's report may not be why the market closed lower. Technical analysis of the type I do predicted lower prices--I didn't need to know any "fundamental" market reasons for it. Looking toward the 10375 target which we'll probably make on Monday.

Although the market reverse course today and closed up almost 62 points, it was an outside day (the high and low were higher and lower than yesterday's price bar). The target of 10375 (or 6) is still a valid one and the downtrend should resume tomorrow. This is and will continue to be a down week for the Dow Industrial average.

Although the market reverse course today and closed up almost 62 points, it was an outside day (the high and low were higher and lower than yesterday's price bar). The target of 10375 (or 6) is still a valid one and the downtrend should resume tomorrow. This is and will continue to be a down week for the Dow Industrial average.

As predicted and expected, the market went lower, closing down 65 points, or so. The target of 10376 is still a good one, about 180 points lower than where the Dow is now. Again, if the market is going signicantly lower, the target of 10376 will just be a point where the market will pause and move sideways then resume a down trend. It still could make that target this week.

As predicted and expected, the market went lower, closing down 65 points, or so. The target of 10376 is still a good one, about 180 points lower than where the Dow is now. Again, if the market is going signicantly lower, the target of 10376 will just be a point where the market will pause and move sideways then resume a down trend. It still could make that target this week.

Although the Dow was up 17 points today, the price bar was basically an "inside" day-the high and low within yesterday's high and low. Based on this sideways move a revised target has been generated: 10633-(10890-10633) = 10376. I line has been drawn on the chart at that level. If this is going to be a significant downtrend, this target will only be a pause to much lower prices. Let's see if it can make the target this week, or go sideways a little bit more.

Although the Dow was up 17 points today, the price bar was basically an "inside" day-the high and low within yesterday's high and low. Based on this sideways move a revised target has been generated: 10633-(10890-10633) = 10376. I line has been drawn on the chart at that level. If this is going to be a significant downtrend, this target will only be a pause to much lower prices. Let's see if it can make the target this week, or go sideways a little bit more.

The downtrend continues, although a mild down day today. I expect and predict lower prices next week based on my indicators. 10410 looks like a good target for the swing, for now.

The downtrend continues, although a mild down day today. I expect and predict lower prices next week based on my indicators. 10410 looks like a good target for the swing, for now.

The weekly DJIA chart shows the 179 point drop for the week, although the last price bar is still green. It should turn red next week if the downtrend continues (which I expect). The CCI indicator at the bottom has gone down each of the last two weeks and the stochastics indicator above it is still very overbought. Another down week is predicted.

The weekly DJIA chart shows the 179 point drop for the week, although the last price bar is still green. It should turn red next week if the downtrend continues (which I expect). The CCI indicator at the bottom has gone down each of the last two weeks and the stochastics indicator above it is still very overbought. Another down week is predicted.

We had a mild up day in the Dow today, and although it just missed being an inside day and was a reversal day, I think it presents an opportunity to project the first target on this down move. Note the CCI indicator just crossed the zero line today.

We had a mild up day in the Dow today, and although it just missed being an inside day and was a reversal day, I think it presents an opportunity to project the first target on this down move. Note the CCI indicator just crossed the zero line today.

The target for this move is 10650-(10890-10650)= 10410

The DJIA may go up a little tomorrow, but more likely will go sideways, possibly closing lower. Look for lower prices next week.

The Dow tried to go up today, but couldn't hold the gains and closed down 33 points. We still don't have an indecision point, but tomorrow may bring that narrow range between the high and low of the day and then we can project a target for this downward swing. The downtrend continues.

The Dow tried to go up today, but couldn't hold the gains and closed down 33 points. We still don't have an indecision point, but tomorrow may bring that narrow range between the high and low of the day and then we can project a target for this downward swing. The downtrend continues.

As predicted yesterday, the market started to tank today. The DJIA closed down almost 99 points today and this is just the start. I heard a nationally known financial commentator before the market opened discounting yesterday's market drop and saying that he expects a rise in the Dow because of 4th quarter earnings coming up. Well, I don't about the earnings, but I don't have to know to predict the market direction. That's the problem with fundamental analysis--you have to be right not only on the market direction, but why it should happen to behave that way, as well. I wonder what he said after today's market action.

As predicted yesterday, the market started to tank today. The DJIA closed down almost 99 points today and this is just the start. I heard a nationally known financial commentator before the market opened discounting yesterday's market drop and saying that he expects a rise in the Dow because of 4th quarter earnings coming up. Well, I don't about the earnings, but I don't have to know to predict the market direction. That's the problem with fundamental analysis--you have to be right not only on the market direction, but why it should happen to behave that way, as well. I wonder what he said after today's market action.

It's still too early to predict a price target for this downward swing, but we'll watch closely for that opportunity.

With the Dow closing down 54 points today, an outside day price bar, the downtrend has begun. How far will the market go down. We'll give it a few days and see if there's an indecision point which will help us project a target.

With the Dow closing down 54 points today, an outside day price bar, the downtrend has begun. How far will the market go down. We'll give it a few days and see if there's an indecision point which will help us project a target.

Daily DJIA Friday, December 31, 2004

Instead of moving up toward 11000, the Dow closed lower today and the price bar has turned red. Although this could be a false move downward and the Dow could still move up, the indicators below show a very overbought market and the CCI has been trending downward for a few days.

Instead of moving up toward 11000, the Dow closed lower today and the price bar has turned red. Although this could be a false move downward and the Dow could still move up, the indicators below show a very overbought market and the CCI has been trending downward for a few days.

How can we reconcile the downward bar of the monthly chart, the upward prices of the weekly chart and the now downward move in the daily chart? At this time, I'm still trying to learn what the market is telling me about its direction. Of course, by the market, I'm referring to the psychological participation and bias of the market participants, the crowd mentality. It's because I believe that crowd behavior is somewhat predictable based on early adapters jumping in, the vast market participants coming aboard next and the laggards getting "stuck" at the end of a trend that I'm endeavoring to determine if some indicators will enable me to spot each of the types of market participants. I've still got a way to go, but detailing and blogging my thoughts is focusing me on what makes the market really move.

I hope for a profitable 2005!

Montly DJIA through December 2004

Here's the monthly chart of the DJIA, back from 1978-Dec. 2004. The price bars have been red until the month of December and now that the bar is green, it would seem to indicate higher prices for the Dow. However, if you look back over the chart, there are occasions where there's a single price bar of a different color, then the previous color resumes after that---I guess you could call it a fake-out move, or false move. Is December 2004 a false upward move, not indicating a new trend higher, but an exhaustion of the upward price swing? It's really unclear from the indicators I use, so I can't make a prediction from this chart.

Here's the monthly chart of the DJIA, back from 1978-Dec. 2004. The price bars have been red until the month of December and now that the bar is green, it would seem to indicate higher prices for the Dow. However, if you look back over the chart, there are occasions where there's a single price bar of a different color, then the previous color resumes after that---I guess you could call it a fake-out move, or false move. Is December 2004 a false upward move, not indicating a new trend higher, but an exhaustion of the upward price swing? It's really unclear from the indicators I use, so I can't make a prediction from this chart.

Weekly DJIA through 12/27/2004

Traditional technical analysis says that you should make decisions to enter a market based on a longer term view, then trade the market with a shorter viewpoint. In this mode, I'm presenting two additional charts, the weekly chart (directly above) and then monthly DJIA chart (above this one).

Traditional technical analysis says that you should make decisions to enter a market based on a longer term view, then trade the market with a shorter viewpoint. In this mode, I'm presenting two additional charts, the weekly chart (directly above) and then monthly DJIA chart (above this one).

From this weekly chart you see a bullish picture for the DJIA with a price target of (10493-9660)+10493= 11326 (the first two levels are indicated by blue horizontal lines on the bar chart). The price bars continue to be green, an upward sign.

Tempering that prediction, however, are the stochastics and CCI indicators below the price bars, showing a very overbought market. However, we'll see if the market makes it up to 11326 before a big move downward.