Thursday, December 30, 2004

Wednesday, December 29, 2004

The Dow closed down 25 points today after being lower intraday. The market is definitely turning downward, but will it reach the 11000 target that's so close, 100+ points away? It's possible, but it will have to do so quickly. The market is poised for a drop and far overdue for one. We'll watch tomorrow closely.

Tuesday, December 28, 2004

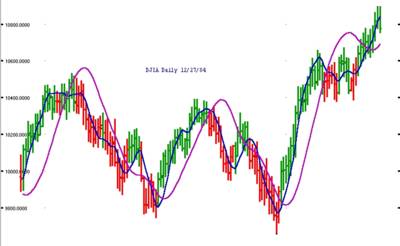

Monday, December 27, 2004

Thursday, December 23, 2004

Wednesday, December 22, 2004

The Dow moved closer to our target of 11000, going up 56 points today. When I say "our target" it seems pretty obvious, and has for the past couple days, that the market would go up to that level. Let's see how the week ends up and whether 11000 is reached by Christmas. (It would be a big move, so I doubt it).

Tuesday, December 21, 2004

Monday, December 20, 2004

Is 11000 on the Dow the new target? More sideways movement occured today, with the DJIA closing up almost a dozen points. Going toward Christmas this Saturday, I don't expect any dramatic moves, with a slightly positive bias. After sales figures come in next week, we may see a little bit of a move, but still, it's the end of the year and not much buying or selling will happen.

Friday, December 17, 2004

As predicted yesterday, the Dow closed lower, 55 points lower, in fact. If today was an indecision day, the target for this upmove would be 11000, about 300+ points from here. I still can't bring myself to think the market will continue to move higher. I don't place much regard to volume, but today was a higher volume day then we've seen recently. The fundamental reason (excuse) is that funds are locking in their yearly gains now. I don't know if that's true or not, and really no one does, but yesterday might have been the high for December. I don't think we've ever seen a big sell-off around Christmas, and unless there's a dramatically bad event, I don't think we'll see one this year either. The Dow will probably just move a little each way next week.

Thursday, December 16, 2004

The Dow continued slowly upward again today. The slow stochastic indicator is well over 90% and the long term moving average is pointing south, but the market creeps higher. The price bar is still green, so the momentum is still higher, but...

I expected tomorrow to be a short-term low, let's see if that comes to pass, at least. I'm examining other indicators to see if they can help.

Wednesday, December 15, 2004

Tuesday, December 14, 2004

The market keeps going up. Today the Dow was up 38 points. No question I've been wrong about the timing of the downturn to come. The price bar is green, but the Stochastics indicator below the price bars is very, very overbought and the long term moving average has decidedly turned down. How much longer will the market soar? This could be a big fakeout-breakout to the upside, or we could see a nice continuation tomorrow and Thursday. Friday, due to cyclical indicators (not shown) appears to be down day. Let's see if the DJIA goes up tomorrow or makes that long-awaited reversal (long awaited by me, at least!).

Monday, December 13, 2004

The market made a stron move upward, 95 points plus today. The market is still very overbought, but now the price bar has turned green again and the shorter moving average has curver upward again. Tomorrow is the key day--will the market close lower and then start a downtrend or go quite a bit higher. We'll see what tomorrow brings and I tell you what I think it predicts.

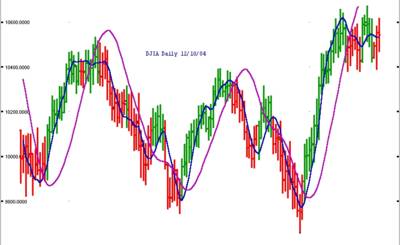

Friday, December 10, 2004

A reversal day to the downside today. The Dow closed only 9 points lower after making a higher high. This appears more and more to be a sideways triangle formation with small swings up and down until a big resolution one way or the other occurs. I still believe the resolution will be downward. Triangles are either halfway continuation moves (and as such you can measure how far the move will go) or they signal the end of a swing. The latter is what I favor at this time. It make take a few more small moves to shake this out, but when the breakout happens, the move, whether up or down will be significant. With the indicators the way they are, downward is where I'd put my money.

Thursday, December 09, 2004

Well, an outside day and a reversal day at that. Does this change my prediction of 10280 for a target on the Dow. No, at least, not yet. The bar is still red, the shorter proprietary moving average is still pointing south, but tomorrow will tell. If the prices go higher than Monday, we'll reevaluate, otherwise we'll look for a break below yesterday's low. Tomorrow should tell the story of the next few sessions.

Wednesday, December 08, 2004

DJIA Predicted Low is 10280

The market didn't go down from the open, but made the low of the day just after the opening bell. However, the market made an inside day, recapturing a little less than 50% of yesterday's drop. The price bar is now red, the shorter moving average has turned down and the market will go lower.

Today's action does give us a chance to predict how far down the DJIA will go on this swing. The high on Friday 12/3 was 10670, the middle of today's price bar is around 10475 so the predicted low of this move is 10475-(10670-10475) or 10280.

If the market holds around that level, we could see a holiday rally, the one that all the market mavens have been predicting. If it goes below that level after another indecision point, the Dow may go much lower into the end of 2004.

Tuesday, December 07, 2004

As predicted yesterday we had a big down day today, 106 points down on the Dow. There were many opportunities to go short today, tomorrow there won't be. Typically, with a big daily move, traders try to get in even though the train is on it's way down the track. I expect a down day tomorrow from the opening bell, possibly worse than today's fall. Again, I can't predict with these tools how far down the Dow will go, but I fully expect it to drop.

Monday, December 06, 2004

The Dow closed down 45 points, a down day as predicted. As I mentioned on Friday, a big down day should be tomorrow or Wednesday. We'll see how far down after we get another "indecision point" or short-range price bar.

The bars are still green, the proprietary averages still up, but only a thread is holding the stock market up. Look for a bad couple days ahead.

Friday, December 03, 2004

DJIA Daily Friday 03-Dec-2004

Well, I was surprised, though mildly so, that the market closed up today. The more important point was a large outside day, the high and low were both higher and lower than yesterday's price bar. It's a signal of indecision in the market--will it go higher or lower now? It will spring from this point in a significant move even if only for a large up or down day. I'm still leaning to a big down day, still possibly Monday, maybe by Wednesday of next week.

The price bars are still green and the moving averages are both pointing up. Contrarily, the Stochastic and CCI indicators below the price bars are still very overbought. We'll see how this resolves early next week.

Thursday, December 02, 2004

DJIA today ultimately went down 5 points. The last two days have been green price bars, indicating the market is going higher. As you can see from the indicators at the bottom, they're near the top of their range, very overbought and likely indicate a much lower market. Again, a big down Monday I predict. How low will the market go? Again, let's see what it tells us early next week. I'd be very surprised if the market was up tomorrow.

Why are the price bars green then? They're based on a 7 day momentum indicator. Compared to the last seven days, yes, the market is higher. But, the longer term momentum indicators, (not shown) still point lower. I'll post them another time.

DJIA analysis for 02-Dec-2004

Still can't show you a chart, but when I can I'll post it. Today, Dec. 2, the market started lower, rose, then fell 5 points lower than yesterday on the close. The upside momentum of yesterday is over. The market will go lower tomorrow and may have a BIG down day on Monday. What events could be used as an excuse if the market goes lower--who knows, the financial press will think of something. They always do.

DJIA Daily Wed 01-Dec-2004

Having a problem uploading the chart today. Needless to say, my prediction of the market accelerating to the downside was WILDLY WRONG! I told you I'd be honest and not cover up my errors. The market went up 162 points today. The only question is, does this represent a last gasp upward, or not? If it breaks above the high of this last swing and stays above it for a day or two, then the market is going higher. If it just tests that high, possibly just going beyond it, the market will tumble in a big way. I expect some follow-through to the upside, at least at the open on Thursday. If the market were to have a reversal day tomorrow, again, it would be quite bad for the DJIA.